I was deeply saddened to learn of the sudden passing of Brian Dovey, a partner at Domain Associates and a family friend on August 27. Imagine my surprise at receiving a signed copy of his new book, synthesizing so much of what he had learned in decades of investing in young entrepreneurs and nurturing companies that have made a material improvement in human health and flourishing.

Years-long opportunities to exchange ideas

I first met Brian Dovey, a venture capitalist and entrepreneur, through Eileen Galton, a dear friend of mine who worked with Brian and his partner, Jim Blair, at their investment firm Domain Associates. Unlike a lot of firms operating in this space, Domain partners always sought to form win-win relationships with their investors, entrepreneurs, and other business partners. As Jim puts it, “We started Domain to create new companies that could translate scientific and technological breakthroughs into new, innovative medicines and medical products that make a difference in people’s lives.”

The company has had an incredible track record, and some of Brian’s own investments have made a big difference in people’s lives. From brand-name breakthroughs like the Epi-pen to major players in the world of biotech today, such as Amgen, since 1985, Domain has raised nine funds and has been involved in the formation of more than 260 portfolio companies. Its companies have created numerous U.S.-approved products that have advanced human health. They have also developed innovative investment models, such as specialty pharma and global in-licensing, which have proven successful and have been widely emulated in the life sciences industry. Domain has raised more than $2.8 billion in capital to date.

The teaching side of things

I was introduced to Brian when he had the idea and the opportunity to teach young entrepreneurs and MBA students and wanted to know what teaching was like. We had a great – if somewhat grounding – conversation about the rigors of teaching and the time it takes for class preparation and grading and he decided to take the plunge, becoming one of the most popular instructors at San Diego State University leading a course called, “Managing the Growing Firm.”

He and his co-instructor Alex DeNoble created a course, that follows his philosophy that getting the business idea for a new business is indeed the easy part. Part of his motivation for writing the book was, as he said, “myths and false impressions about entrepreneurship and startup culture have continued to spread. Fans of “reality TV” shows like Shark Tank still think they can make a fortune from a clever idea and a slick elevator pitch. And detractors really think the startup world is full of egomaniacs and dishonest “vulture capitalists.” Both camps are very far from reality, as I explain to a new group pf SDSU students every semester.”

The goal of his book was “aiming for the sweet spot between starry-eyed optimism and dour negativity.” As he points out films like the “Social Network” and TV shows like Shark Tank are rather poor guides to achieving venture success.

Of risk, corporate and entrepreneurial

One of my favorite conversations with Brian was about the nature of entrepreneurial risk, and why he had decided to go the entrepreneurial, venture capital route. He related his experiences at Rorer, then a leading pharmaceutical and medical device company. He was promoted to Executive Vice President for all of Rorer’s strategic planning, plus pharmaceutical R&D as well as running his own division. As he notes in his book, “Office politics started wearing me down.” Not only could he not avoid them, the countless hours on trivia were grinding and his role seemed to be to perpetuate them, not eliminate them. As he puts it, “My attempts to say, “Who cares, let’s focus on what’s important were not appreciated.”

The event that pushed him over the edge was a hugely time-consuming meeting with the 13 top-level executives of the firm to make the consequential decision of … the Christmas party. “Should it be paid for employees, the company, or a combination of the two?” As he recalls later, he wasn’t aware of just how unhappy he’d been about that job. He left to explore entrepreneurial pursuits.

My favorite saying of his from that time in his life has to do with losing the security of the corporate mothership. “You know, Rita,” I recall him saying, “when you are working on a startup, you have the risk that the business doesn’t work in the marketplace. When you’re working on innovation in a corporate environment, you have that risk PLUS the risk that the company won’t support your efforts, so it’s actually riskier to take the seemingly safe route within the company.” That observation has stayed with me through decades of working with corporate innovators to overcome the built-in antibodies that make it so much like slogging through mud.

The five criteria for investing in a startup

Brian lists five criteria that he used to judge startup proposals.

- Market: Are you addressing a true unmet need, or is it just nice to have?

- Competition: Who will be threatened by your idea, and how will they respond?

- Technology: Do you have the technical capacity to execute your idea at scale?

- Proprietary position: What’s your unfair advantage that will stop others from copying your idea?

- Financial requirements: Can you generate enough cash before going broke or before your investors bail out?

He tells a great story in the book about trying to estimate the market for “impotence” (later re-labeled Erectile Dysfunction or ED) treatments. Before we had Viagra, there was a small company called Vivus, which developed the first FDA-approved treatment for the condition. In the early days of market research, his team spoke to lots of doctors about whether men were seeking treatments, only to be told, no, it was a tiny fraction of the male population that was suffering. But, as they spoke to regular guys, like taxi drivers and their buddies, about what they were creating, many asked for samples, leading them to realize that “The product wasn’t just for those with a serious medical problem.” Later on, in a discussion with the FDA, a reviewer suspiciously asked, “How do you know this won’t be used for recreational sex?” To which Brian replied, “What other kind is there?”

The rest is history – the word of mouth leading up to the launch was so overwhelming that the product was out of stock in a week, and it was the gold standard in its field until Pfizer’s launch of Viagra.

The book really is chock a block full of gems like this one: “Founders often ask me how many VCs they should have on their boards. It’s a tricky question because VCs tend to be smart but strongly opinionated. I recommend what I call the martini rule: one rarely feels like enough, two is probably ideal and three or more is asking for trouble.”

Isn’t that great?

A personal note

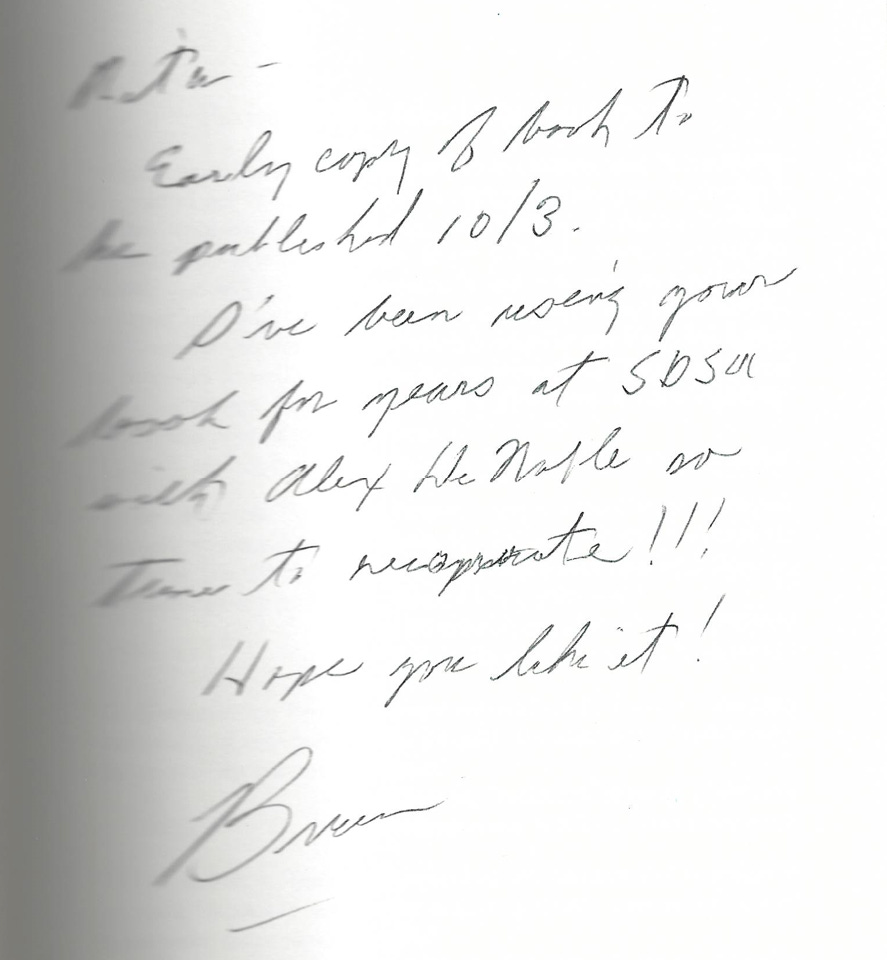

Brian died unexpectedly on August 27, 2023, with his wife of 60 years, Betty, at his side. As he doubtless would have wished, he was hard at work on the tasks of getting his wonderful, personal, and deeply wise book into the world, and had already begun to sign copies for friends and influencers as part of the planned October 3 book launch. Much to my astonishment and delight, he had signed a book for me before his death, which his family kindly forwarded to me.

The dedication reads,

Rita, an Early copy of book to be published 10/3.

I’ve been using your book for years at SDSU with Alex DeNoble so time to reciprocate!!!

Hope you like it!

Brian

I could not have been more honored or grateful to be remembered fondly by someone with Brian’s generosity and talent. I’m so glad he took the time to write the book. It’s wise, witty, and full of personal reflections from his years on the front lines of entrepreneurship. As he says, by reading it, you can maybe avoid the mistakes he’s made. Make your own, instead!