This article was co-authored with Alex Van Putten of Cameron & Associates

It isn’t hunger for short-term results. It’s not about meeting every number. It’s not about never being surprised. What investors really want is to see evidence that you are using your imagination.

When all around you are retrenching…

We are once again at that unenviable part of the business cycle when uncertainty looms high, the spigot of easy money has suddenly been shut off and as Warren Buffett famously said (in his annual letter to shareholders of Berkshire Hathaway In 2001), “we’ll see who has been swimming naked.” What’s going to happen is predictable.

Companies that only recently were talking big plans for innovations like the metaverse are now touting their commitment to “the year of efficiency” (looking at you, Meta). All that innovation nonsense? Bah, humbug – we’re back to the core, back to repeatable and predictable business and jettisoning all that silly exploration of ‘what’s possible’ stuff. Take on uncertain investments? No ma’am, we’re strictly back to grinding out the day to day. For our take on the negative consequences of this behavior, see this article.

The thing is, while it may be all-too-human to want to crawl back into the safety of a well-understood part of your business when facing big unknowns, that isn’t going to impress your investors. We can demonstrate this, using a metric we call the “Imagination Premium.” Our hope is to get this metric into more conversations as we believe it is a perfect antidote to the backward-looking performance measures that so often are used to assess corporate performance.

The imagination premium – ignore it at your peril.

The share price, and hence market capitalization, of a publicly traded company reflects two sources of value. One is the value of the cash thrown off by company operations. The other is the perceived value of growth. Divide the value of growth by the value of operations and you get a metric we call The Imagination Premium (TIP).

A high TIP suggests that investors have confidence in management’s ability to generate organic growth through innovation. Think of a high TIP as a free boost to your market capitalization. Management has both imagined a bright future and effectively conveyed its vision to analysts and investors.

If, on the other hand, your TIP is low or, God forbid, negative, that means investors have decided that your future looks dim. This is almost always terrible news for incumbent management teams. You’ll attract activist investors, calls will be made to break up your company, hostile acquirers start sniffing around and usually there will be demands for the CEO’s head to roll.

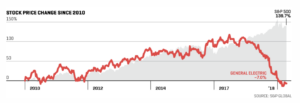

For instance, in 2017, when then-CEO Jeff Immelt announced that he was stepping down earlier than planned, our internal analysis, based on estimated 2017 cash flows, put GE’s TIP at .49. This is in comparison to the TIP measures of comparable companies such as Honeywell (.97), 3M (.93) and Ingersoll-Rand (1.11). TIP predicted the underperformance that ultimately culminated in Immelt’s departure.

As Geoff Colvin of Fortune somewhat snarkily observed, “it’s a bad day for a CEO when he announces he’s retiring and the stock goes up.” That was just the beginning, as GE’s stock price (amidst a globally booming economy) continued to crater. As Colvin continues, “GE has repudiated its previous leadership with a zeal unprecedented in a company of its size and stature. Gone in the past 10 months are the CEO, the CFO (who was also a vice chair), two of the three other vice chairs, the head of the largest business, various other executives—and half the board of directors.” The conglomerate proved too unwieldy to save, and it was announced in 2021 that GE would be broken up into three separate companies.

The lesson is that no amount of reputation, PR, or CEO buzz-speak can cover up a boring story about the future. To create a high TIP, investors must genuinely believe that your company is on an exciting track to making big things happen.

The Logic of TIP applies, even in tough economic environments

To illustrate how TIP fits into performance measurement, let’s compare Tesla with BMW. BMW is a pure play car manufacturer, unlike Tesla, which is also into batteries, solar panels and more. BMW is positioned as a premium established company. Tesla, as a tech upstart.

Tesla’s vehicles were designed from the ground up, with all-electric and software-enabled features built-in right from the start. In addition to notable advances in battery technology, the cars are stylish, and the parent company so well known for innovation that it’s been featured in the Harvard Business Review. BMW fits more readily into the mold of a traditional car company, with the legacy that implies.

When mainstream automotive manufacturers were shut down by chip shortages, Tesla blithely continued to run its production lines unencumbered. As Jack Ewing, a New York Times reporter noted, “When Tesla couldn’t get the chips it had counted on, it took the ones that were available and rewrote the software that operated them to suit its needs. Larger auto companies couldn’t do that because they relied on outside suppliers for much of their software and computing expertise.” The disadvantages of the incumbents presented a golden opportunity for Tesla.

In 2022, Tesla reached a watershed moment. The upstart sold more luxury cars in the United States than BMW for the first time. So much for BMW management declaring, with respect to the startup’s extraordinary selling proposition for electric vehicles, “that’s over.”

BMW’s management is clearly struggling to remake its image as a hot technology innovator. For instance, the designs for several of their new models have been politely called “controversial” and more rudely, “bizarre.” The company’s Chairman, Oliver Zipse, shrugs this off, arguing that they are mechanisms to garner publicity, to bring public attention to the company. As he said, “I want controversy. If we don’t have controversy (in the early design process), I already know it’s too easy. In the early design if you do not have controversy, that’s the mistake you make. Out of the controversy you get engagement. You get people thinking about it and thinking about alternatives.”

Well maybe, but if sales are to be believed, more customers are buying into the Tesla vision than that of the BMW’s, no matter how edgy.

BMW has made other missteps that infuriated customers. A decision was made to install heated seats in all their cars but disable them unless their buyers, who were forking over $70,000 plus for their car, paid a subscription of $180 per year to use them. Wait! What? Not surprisingly, it faced a firestorm of protest from buyers about this attempt to milk consumers for hardware that was already installed, bringing forth a social media and press backlash. Not that this sort of thing is new to the auto industry – manufacturers have been using similar maneuvers for years.

Buzzy or boring?

So how are we to compare the performance of these two companies, now meeting head-to-head in the world’s luxury car markets? BMW trades at a price-to-earnings (PE) ratio of 6, about the norm for a mature, slow-cycle industry. By comparison, Tesla trades at a PE ratio of 50, the kind of ratio one would expect for a high-growth company. More astonishingly, Tesla, due to its high TIP, enjoys a market cap of $605 billion as of this writing, nearly 10 times that of BMW’s €68 billion (about $72.8 billion US), even though the older company sells more cars and has more revenue.

2022 did not disappoint for Tesla advocates. As described by NPR, “Tesla reported record profits and record revenues for 2022…Profit for the year hit $12.6 billion, more than doubling since 2021 and beating the expectations of most analysts.” BMW on the other hand, referred to its 2022 performance in its own press releases as, um, “solid.”

So, are investors excited about what BMW is up to in the high growth, disruptive markets that are predicted to shake up the automotive sector? Not so much. Even though BMW’s revenues have shown steady growth since 2020, it’s TIP is -0.62.

That is not good. Investors are reluctant even to pay for the value of its operating cash flow, which is 140% of that of Tesla. Investors are not wowed by the electric BMWs coming out, and clearly don’t see avenues to above-trend growth. Perhaps to pacify its investors, the company has just announced a major stock buyback, a decision which has been linked by the research of William Lazonick, among others, to a lack of innovative potential and eventual value destruction.

If we were advising BMW, we’d be looking at amping up its innovation program, potential for making acquisitions into higher TIP areas, and telling a better story than “we want controversy.”

Is Tesla’s astronomically successful performance in TIP terms a predictor of things to come? Yes and no. Its TIP has increased more than five-fold from 1.45 in 2019 to 6.17 at the end 2022. At first glance, this is both remarkable and positive. However, during the same period, Tesla’s operating cash flow increased by a staggering 612%, from $2.4 billion to $14.7 billion. Again, this is remarkable.

But here’s the rub. If investors expected Tesla’s role as a breakthrough company to continue, its TIP should have increased by an even greater extent than its cash flow. That didn’t happen. In our view, this signals a transition in investors’ perception of Tesla as a category-creating innovator to become more closely aligned with the valuation accorded to a traditional car company. That’s not necessarily a bad thing, indicating as it might Tesla’s right to take its place in the sector among the more established auto companies.

Its high TIP of 6.17 is noteworthy. And while it creates a huge benefit for Tesla in terms of the company’s value, it also means that any slipups in execution or signs of an inability to realize the vision will bring the TIP crashing down, as it has in the past.

And the lessons for performance are…

Companies with low imagination premium scores (anything too much under 1) are not seen as exciting investment darlings. They are often perceived as weak, relative to competitors with higher TIPs. That can make them vulnerable to interest from activists, calls for management to be replaced, griping by stock market analysts and even hostile takeover attempts. It’s not easy being boring.

Companies with high imagination premium scores are thought of as growth engines, which is associated with approval from investors and general satisfaction with the performance of management. The risk, of course, is that you must deliver, or that high score will once again evaporate.

Interested in how your TIP stacks up? Contact us for a free assessment.

Coming next week: How acquisitions can influence TIP.