Seeing Around Corners: Anniversary Edition – Not a Moment too Soon!

Hard as it is to believe it, Seeing Around Corners celebrated its first anniversary on September 3rd and even I could not have predicted its timeliness. The book, which covers strategic inflection points, looks at how you can see them coming, how to decide what to do about them and most crucially, how to bring the organization with you. One of the major insights from the book is that while inflection points feel as though they knock you flat when they reach a tipping point, instead they typically proceed “gradually, then suddenly.” Wow! Did we get a crash course in that this year… But, even the global pandemic, economic, social and environmental inflection points that are coming together with such vividness now, had many an early warning.

So, let’s look back.

Data Brokers and Social Media. In the book, I suggested that there were plenty of warnings that the economic model of using people’s personal data to sell targeted advertisements could come under threat. That hasn’t slowed Facebook down, yet – its revenues were over $70 billion in 2019, strongly up from 2018. Still, 2019 saw the passage of the California Consumer Protection Act (or CCPA) which has started to toss a bit of grit into the fast-moving flows of data from your fingers right to advertisers. More radical than this, however, is a proposal suggested by startup entrepreneur David Heinemeier Hansson. As he suggested in a conversation with Wired Magazine, “The solution to our privacy problems… was actually quite simple. If companies couldn’t use our data to target ads, they would have no reason to gobble it up in the first place, and no opportunity to do mischief with it later. From that fact flowed a straightforward fix: “Ban the right of companies to use personal data for advertising targeting.” With an ever louder chorus of voices demanding greater privacy protections for personal data, that inflection point may be underway.

Microsoft. I was very enthusiastic in the book about Satya Nadella’s talent for not just getting great ideas (never a problem at Microsoft) but his ability to galvanize the organization toward a common goal. Well, if stock price is any indication, he does not disappoint. The stock price on the publication date of Seeing Around Corners was $136.04 (according to Yahoo Finance). One year later, it is at $226.19. It’s market capitalization is $1.7 TRILLION dollars. It is, as one observer noted, “one of the most compelling turnaround stories in recent history. And it all sprang from a simple concept – empathy.

Klöckner. I’ve long been enthusiastic about this German metals-distribution company and its digital champion, CEO Gisbert Rühl. Klöckner had a difficult 2020, as did many firms that depend on smooth flows of global commerce and demand for steel in sectors such as automotive. The company did indeed suffer lost profitability in 2020, but interestingly enough at the one-year anniversary of the book’s publication, its stock, which had wavered, had nearly recovered to its previous levels, a strong indication of investor confidence. In true “Seeing Around Corners” style, the company created its own inflection point by making a huge commitment to digitalization before they needed to. Without that, the current downturn could have been catastrophic for them.

The energy grid. One of the early warning scenarios that I pointed to in the book involved the switch in energy provision from centralized grids, generally running fossil fuels to markets leveraging renewables. That was indeed what came to pass, and even vaunted General Electric, in its acquisition of Alstom’s mostly fossil-fuel based business missed the scenario in which demand was relatively flat and renewables became price competitive.

Pharmaceutical Spending. Todd Bisping, Caterpillar’s Compensation and Benefits manager took a steely look at Caterpillar’s exploding costs for pharmaceuticals for its massive workforce. Using skills honed as both an entrepreneur and with his supply chain background, he figured out that there was somewhere in the neighborhood of 30% “waste” in a system that appeared to be deliberately designed to lack transparency. He tackled each piece of the tangle that represents the system as it has grown up, from creating an in-house formulary to negotiating with pharmacies. As other companies seek to follow Cat’s lead, we may well see a shift in the balance of power in the way drugs are priced and distributed in the United States.

Women’s Leadership… or was that just Leadership? In Seeing Around Corners I made the case that many of the behaviors we have long associated with women’s leadership – building webs of inclusion, being open to new ideas, creating greater levels of psychological safety, recognizing the contributions of others and fostering healthy debate and feedback – are coming to be recognized as qualities that we should aspire to seek in all our leaders. Tomas Chomurro-Premuzic and I had a very revealing Friday Fireside Chat about why we so often end up with disappointing leaders, many of whom are male. His conclusion is that if we really looked for the qualities we know we want, we would make it harder to confuse confidence with competence and for incompetent leaders to rise.

It is really interesting, therefore, to see the leadership traits emphasized in the book show themselves in the way different leaders have confronted the COVID-19 pandemic. Many observers have pointed out that the countries that have had the best response have been led by women. Their behaviors mirror, in many ways, the leadership archetype I describe in the book as being most suited to navigating through an inflection point. Calm, fact-based, open to hearing uncomfortable information, leading through feedback and simplifying complexity were all characteristics that seem to have been associated with earlier lock-downs and more successful effects at containment. And showing empathy, as Nadella did at Microsoft, seems to contribute to populations being willing to sacrifice for a common goal.

Higher Education. The onset of COVID-19 has revealed an underlying truth about higher education (and higher education pricing) that many have preferred not to acknowledge. This is that the life-changing, coming-of-age (to quote Paul LeBlanc) experience students are paying for is only lightly correlated with what is happening in classrooms. Instead, it is the experience of being on campus, the spirit at the big games, the chance to be with a bunch of other people your own age, and so on, that is the ‘real’ college experience. And, increasingly, it is an experience that is unaffordable. The average cost of tuition and fees nearly quadrupled from the early 70’s to today. The financial implications of COVID, however, are existential for many schools with revenue that used to come from sports, housing and other services coming to an abrupt end. This may reshape the higher education market entirely. Indeed, Bryan Gross, vice president of enrollment management and marketing for Western New England University said “we may be seeing the beginning of the end for the unsustainable high-price, high-discount model that has prevailed over the past few decades in this country.”

What will we see instead? Well for many students the ‘normal’ campus experience is going to be unaffordable. Even for those who can afford it, if instruction is primarily virtual and they can’t return to campus, a splintering of the university degree becomes entirely possible, as I predicted in the book. If I can’t be on campus, why would I not just take the best on-line offering from the best professor I can find, even if they are at different schools? Largescale traumas have tended to lead to innovation in education and this may well be the beginning of a major rethink.

One of the most interesting developments is that groups of students are now renting homes and apartments together, taking their classes on-line and enjoying the “coming of age” experience of their own design! Given potential savings on dorm room and board, this could open up a whole new vector of disruption.

Flatiron Health. The two young founders behind Flatiron health are a perfect example of why thinking in terms of industries can be very misleading. They are serial entrepreneurs with no healthcare experience who created a company to provide an oncology-specific electronic health record. The data proved so valuable that the six year old company was acquired by Roche for $1.9 billion in 2018. Today, Flatiron has partnerships with most of the major pharmaceutical companies, has about 900 employees, and is potentially changing the way the Food and Drug Administration conduct clinical trials.

Hearing Aids. I suggested that big changes would be underfoot in the hearing aid business, once regulations to permit them to be sold over the counter became a reality. While the regulatory change slowly moves through the process, audiologists are wringing their hands over the viability of their practices once more convenient, less expensive alternatives became available. Meanwhile, the hearing aid market continues to grow up and to the right. As I point out in the book, an inflection point occurs when a change – what some people call a 10X change – upends the assumptions that a business is built on. And who benefits? Players like Hear.com, which claims it is the fastest growing distributor of hearing aids in the world, and reportedly have customers that are twice as happy as those of conventional providers. And then there are the playful people over at Eargo who have rethought everything about the experience of being a hearing aid consumer!

Men’s Shaving. Dollar Shave Club, Harry’s, the rising popularity of beards and now a pandemic have put a big dent in Gillette’s shaving business, with their market share continuing to erode. The company wrote down the value of the brand by $8 billion in 2019. Dollar and Harry’s have both been scooped up by much larger firms, Unilever and Wilkinson, giving them manufacturing and distribution scale and strong financial foundations to support their growth.

And in the category of self-inflicted wounds, Gillette’s 2019 “toxic masculinity” ad, while certainly attracting attention, seems to have largely benefitted its upstart direct-to-consumer competitors.

Fashion. In the book, I detailed how traditional retailers for things like apparel were suffering as their customers began to send photos of one another around, creating a situation described by some observers as “fashion bulimia,” where clothing is cheaply made, worn a few times and ends up in a landfill. The traditional model in fashion, with its seasons and previews was already begin challenged by supposedly “new” clothes that customer got bored with before they could even buy them, given the pervasiveness of the Internet. The pandemic accelerated the decline – according to the New York Times, sales of clothing fell 79% in April of that year.

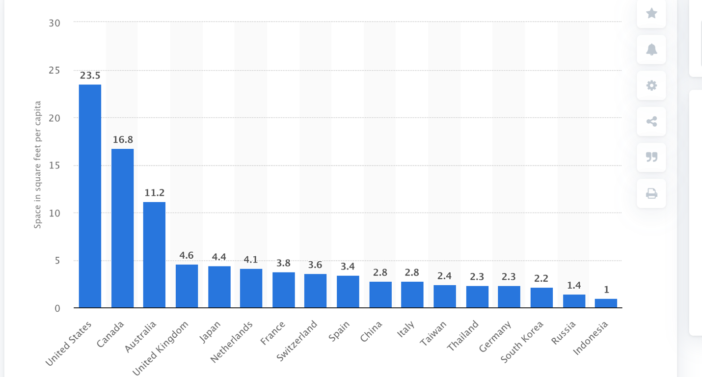

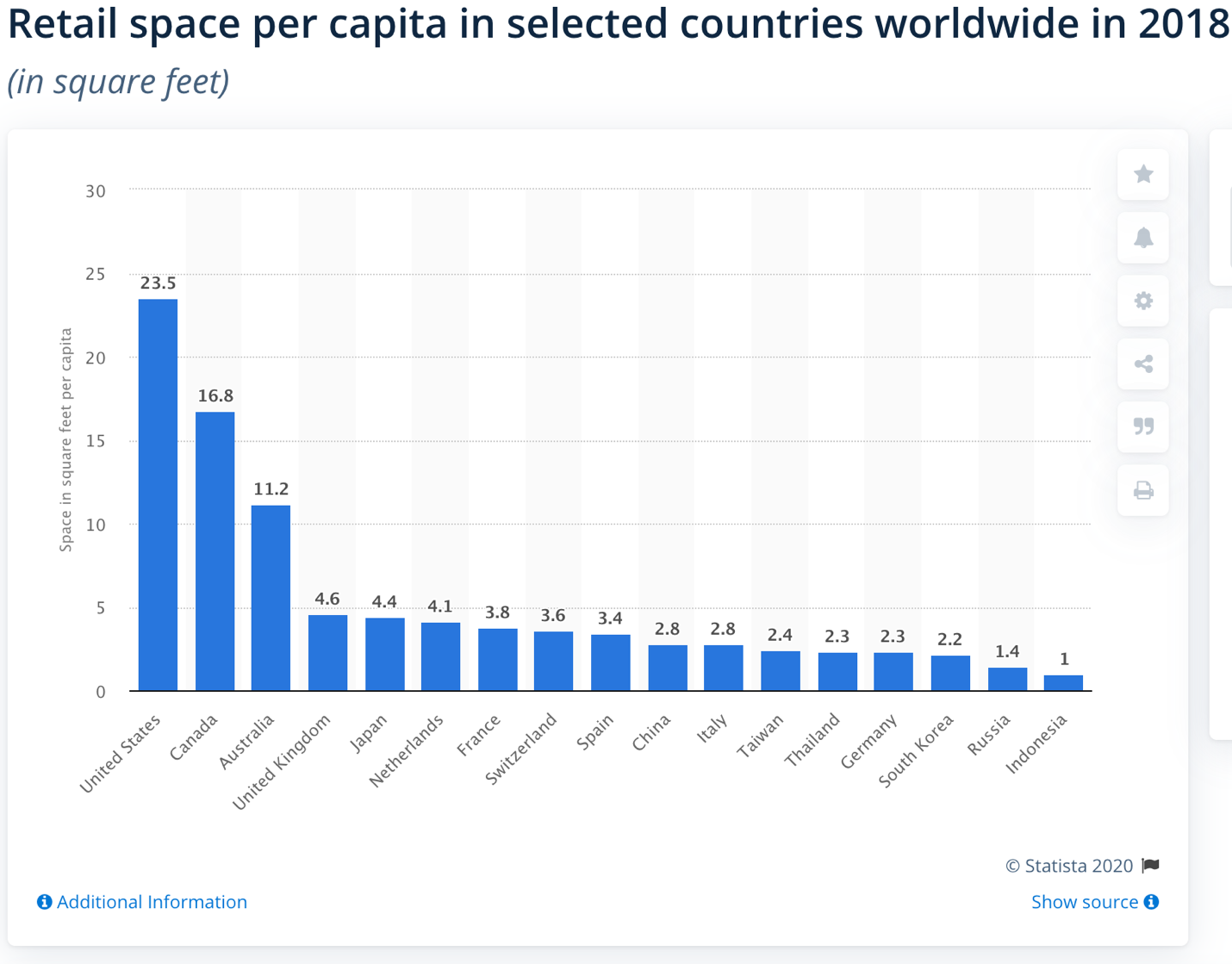

Fashion has also seen the ranks of its retail outlets become decimated. Retailers have confirmed at least 6,300 US store closings for 2020. Stein Mart, Men’s Wearhouse, Lord & Taylor, Microsoft, GNC, JCPenney, Victoria’s Secret, Nordstrom, and Sears are among the retailers that are planning to close stores this year. The pandemic accelerated this trend which was easily seen coming by another metric, retail selling per space per person, where in 2018 the US had 40% more retail selling space than Canada and a whopping five times more than the UK.

Thinker-Tinker and Octobo. I used the story of the creation of Octobo to illustrate the power of discovery driven principles in the creation of both a new company and a new category. Octobo went through a series of what I call checkpoints as its founder, Yuting Su, invented a plush companion robot and brought it to market. Instead of children passively sitting and staring at screens, Octobo’s use of digital technology encourages active play and exploration. Today, the company, which is still private, is valued at around $10 million. It has won awards, and reviews have been enthusiastic. As one reviewer gushed, “There’s no end of educational toys on the market, but Octobo has something special.” The discovery driven method works when applied properly!

What happens next? Well, that is the question on everyone’s mind right now as we grapple with four strategic inflection points – a pandemic, an economic crisis, a crisis of justice and an underlying looming environmental disaster. So let me close this anniversary newsletter with some thoughts.

There will be no instant snapping back to whatever we did in the ‘before’ times. As I point out in the book, being on the wrong side of an inflection point can send your organization into decline. The organizations that emerge from all this stronger are likely to be those that have made decisive choices about what to stop doing and how to redirect their resources into future-seeking activities. It’s become almost a cliché to say that for many works-in-progress, such as digital transformation, the pandemic has proved an accelerant.

One potentially positive outcome, though by no means guaranteed, is a rebalancing of power among the various stakeholders of business. While this was being given at least lip service in the Business Roundtable’s statement that businesses should be responding to the needs of all their stakeholders, we’re starting to see some evidence that a new social contract may be feasible. Eric Ries, of the Lean Startup fame, successfully completed a ten-year effort to launch the Long-Term Stock Exchange, an exchange for which companies need to qualify by adopting stakeholder-friendly policies, such as long term rewards for executives. Zeynep Ton, MIT professor and founder of the Good Jobs Institute has pulled together a number of tools and solutions, including diagnostics and an assessment that can be used to determine if a company is a good jobs employer, or not. Her colleagues have added to this treasure trove with six policies we could use right now. Rebecca Henderson’s wonderful book “Reimagining capitalism in a world on fire” offers several suggested paths forward. We’re also seeing long-overdue progress on the racial justice front, although some critics argue that progress has been slow, and that we urgently need to take action before the topic slips once more out of the news cycle.

Another positive aspects to crises like this one is that it can release enormous creativity. When one path forward is blocked, perhaps that is the incentive to find a new path.

My hope for you all is that the new path be a fruitful one!